Strategic Steel Slab and Ingot Procurement Framework

The procurement of steel slabs and ingots forms the most capital-intensive element for manufacturers. A strategic steel slab purchase begins with a precise Needs Assessment, differentiating the requirements for each product type. For Slabs, the buyer (typically a hot strip mill or plate mill) must define the required grades (e.g., API X60 for pipe, high-strength low alloy for automotive) and dimensions with extreme accuracy, as the slab feeds directly into the rolling process. Steel slab purchase specifications must align precisely with mill capabilities to avoid downtime. Every steel slab purchase must be underpinned by this technical alignment. Click here to view steel slab

For Ingots, the buyer (usually a specialized forging house) requires specific high alloy or tool steel compositions where internal metallurgical soundness is paramount. The purchasing strategy must reflect this dichotomy: Slab purchasing focuses on high volume, continuous supply, and managing price volatility linked to iron ore, while Ingot purchasing focuses on quality consistency, specialized processing audits, and managing alloy price volatility (Nickel, Molybdenum). Steel slab buyers prioritize throughput stability.

Long-term purchasing (12 to 24-month term contracts) is crucial for both to secure capacity from major global mills, mitigating the risk of being shut out during market peaks. Strategic contracts ensure uninterrupted production during demand surges. A forward-thinking steel slab purchase strategy is built on these long-term agreements. Steel slab supply security directly impacts rolling mill utilization rates. Buyers leverage volume commitments to negotiate favorable terms with integrated producers.

Supplier Sourcing and Technical Vetting Protocols

Sourcing reliable suppliers for high-volume slabs and specialized ingots means concentrating on integrated steel producers with advanced casting technology. The vetting process for a steel slab purchase must be exceptionally rigorous, moving beyond financial checks to detailed technical audits. Slab Supplier Audit: The buyer must audit the slab mill’s Continuous Casting (CC) facility, ensuring they utilize modern systems like electromagnetic stirring (EMS) and advanced cooling to achieve homogeneous internal structure.

Verification of their capacity to reliably produce specific high strength, low sulfur slab grades at high volume is mandatory. The buyer should seek evidence of certification from bodies like the Marine Classification Societies (e.g., DNV, ABS) if plates are the end-product. Steel slab audits validate process control maturity. Ingot Supplier Audit: Ingot purchasing requires auditing the supplier’s entire Ladle Metallurgy process, including Vacuum Degassing (VD) and controlled bottom pouring techniques.

These methods are vital for reducing internal defects (pipe and segregation) in high alloy steels. The buyer must confirm the mill’s ability to provide detailed, section-by-section Ultrasonic Testing (UT) protocols for their ingots, a non-negotiable requirement for critical forging applications. Buyers often send their own metallurgists to oversee the casting of their first order, establishing a robust quality checkpoint. Supplier vetting prevents costly downstream failures. Click here to view steel slab

Steel Slab Quality and Rolling Efficiency

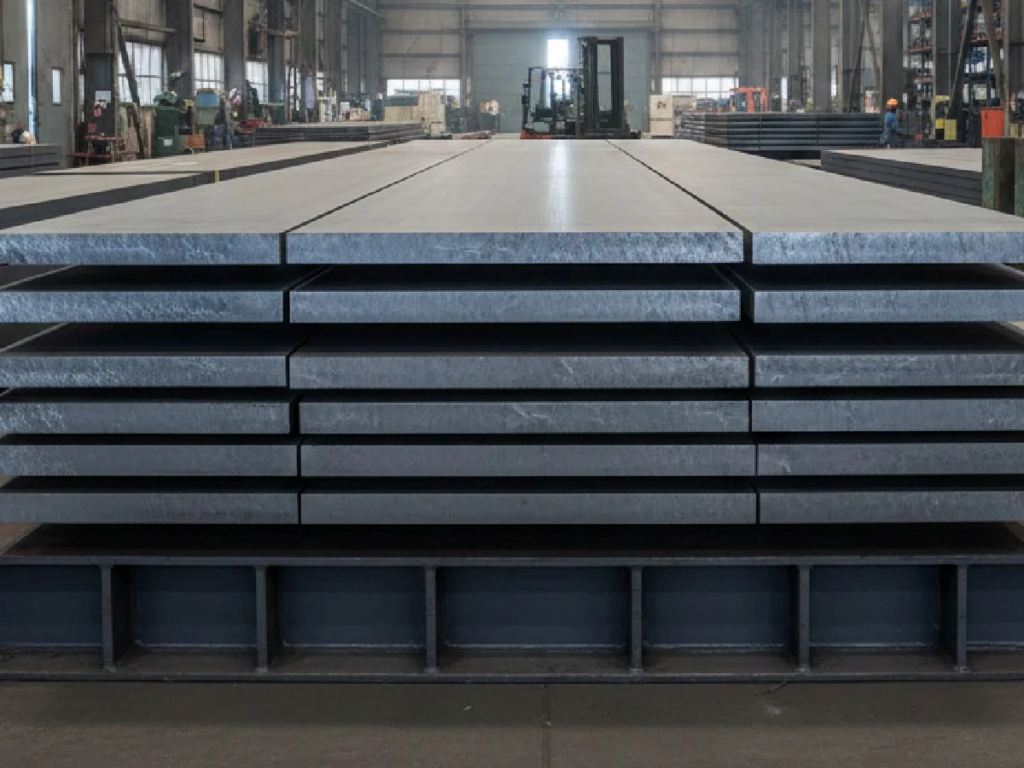

Slab quality directly dictates the efficiency and yield of the buyer’s hot rolling mill. The buyer must enforce tight contractual specifications focused on minimizing defects that disrupt rolling schedules. A successful steel slab purchase is measured by rolling mill yield. Surface Defect Limits: The purchasing contract must specify the maximum acceptable depth and coverage of surface defects (e.g., cracks, scars, or deep scale) that would necessitate costly scarfing or grinding at the buyer’s mill before rolling. Low-defect slabs justify a price premium because they save processing costs. Click here to view steel bloom

Steel slab surface integrity reduces mill maintenance significantly. Internal Homogeneity: For high strength and deep-drawing grades, the slab must demonstrate excellent internal homogeneity and flatness. Segregation (uneven distribution of alloying elements) is a major risk that leads to localized cracking during rolling. The Mill Test Certificate (MTC) must confirm the chemical analysis at multiple points on the slab to verify uniform composition. Steel slab consistency ensures predictable rolling behavior.

PSI and Quality Gates: The buyer must mandate a Pre Shipment Inspection (PSI) by an independent third party. The PSI should visually inspect the surface of the slabs and verify the chemical analysis via sampling. The Letter of Credit (LC) payment must be contingent upon the presentation of a clean PSI Certificate, ensuring that quality control is externally verified before the shipment leaves the load port. This step is critical for any international steel slab purchase. Steel slab verification prevents acceptance of substandard material. Click here to view steel bloom

Ingot Quality Assurance for Critical Applications

For ingots, quality is defined by the absolute internal metallurgical soundness and the precise quantity of expensive alloying elements. The buyer is sourcing material for forging and tool steel where failure is catastrophic. UT Mandatory: The contract for high value ingots must mandate a comprehensive Ultrasonic Testing (UT) report by the seller, confirming the absence of internal piping, major voids, or large non-metallic inclusions.

For a safe steel slab purchase the buyer must approve the mill’s UT procedure and the acceptance criteria based on the ingot’s end-use (e.g., a turbine rotor). Alloy Tolerance: Ingot grades often contain expensive alloys like Nickel, Molybdenum, and Chromium. The buyer must specify a tight chemical tolerance for these elements (e.g., ±0.05%). The MTC must be meticulously checked against the contract, as any deviation affects the final mechanical properties and the buyer’s yield cost.

Testing Witness: Due to the specialized nature of steel slab purchase, the buyer often sends an inspector to witness the UT process and the preparation of the Macro Etch samples (cross-sections treated with acid to reveal internal structure) to visually confirm the absence of centerline segregation before the ingot is shipped. This level of oversight mitigates millions of dollars in potential failure costs. Ingot quality protocols safeguard against catastrophic field failures. Click here to view steel slab

Dynamic Pricing and Market Timing Strategies

Pricing negotiations for slabs and ingots are complex due to their distinct raw material input costs. The buyer must structure the price to manage these specific volatilities. Slab Price Formula: Given their link to primary production, the steel slab price should be tied to the Iron Ore Futures Index (e.g., SGX 62% Fe Fines) and Coking Coal Prices (e.g., Platts Met Coal) plus a fixed Conversion Margin representing the steel mill’s operating cost. Structuring this formula is a core component of the steel slab purchase negotiation.

The formula should allow for the price to be finalized based on the index average over the week prior to the Bill of Lading date. This ensures fair market alignment at shipment time. Ingot Price Formula: Ingot pricing requires a layered formula. It should link the base steel cost to the Iron Ore index, but include a separate, variable component linked to LME Futures (e.g., Nickel, Molybdenum, and Manganese) for the specific alloying elements. Click here to view steel bloom

This structure ensures the buyer pays the current fair market price for the expensive alloy content. Timing the Purchase: The purchasing team must use sophisticated market intelligence to time large purchases during predictable low points in the cyclical market, such as during the seasonal decline in Chinese construction activity or temporary dips in the Iron Ore index. Strategic timing reduces procurement costs substantially for a steel slab purchase.

Financial Risk Mitigation in High-Value Transactions

Given the high transaction values, the LC is the buyer’s primary financial protection tool. It must be meticulously structured to manage risk and cash flow. Conditional Payment: The buyer must ensure the LC is strictly conditional on the presentation of all required documents: the clean PSI Certificate, the UT Report (for ingots), the MTC, and the Certificate of Origin (COO).

The payment should only be released when the physical goods and their quality documentation are verified as compliant. Usance LC for Cash Flow: To optimize working capital, the buyer should negotiate a Usance LC (e.g., 60 or 90 days). This allows the buyer to take possession of the steel slab, begin the long rolling or forging process, and potentially sell the finished product before the LC payment is due to the bank. This is a key cash flow advantage in a steel slab purchase.

This acts as a form of non collateralized financing. Performance Guarantees: For large term contracts, the buyer should demand a Performance Bond (e.g., 2% – 5% of the contract value) from the seller, which is forfeited if the seller fails to deliver the contracted volume or quality on time. Financial safeguards protect against supplier default risks effectively.

Specialized Logistics and Discharge Management

The physical movement of slabs and ingots requires highly specialized logistics management due to their size and density. Incoterm Selection: Buyers should carefully consider choosing FOB (Free on Board) over CFR (Cost and Freight). While CFR is simpler, taking FOB control allows the buyer to charter vessels directly, potentially securing cheaper freight rates and better schedules than the supplier, particularly for high-volume steel slab shipments. Logistics planning is integral to the total cost of a steel slab purchase.

Discharge Efficiency: The buyer is usually responsible for offloading and is exposed to massive Demurrage charges (vessel detention penalties). Discharge ports must be selected based on their capability to handle the cargo’s specific weight and the availability of specialized heavy-duty cranes. The buyer must pre-arrange dedicated logistics chains (rail or heavy trucks) to clear the cargo from the dock rapidly and avoid costly port storage fees. Click here to view steel slab

Marine Insurance: The buyer must secure comprehensive All Risks (ICC A) marine insurance, ensuring the policy covers the full value of the high-value cargo and explicitly covers handling damage during the heavy-lift loading and discharge operations, which is a common failure point. Logistics planning prevents unexpected cost overruns significantly.

Regulatory and Trade Compliance Requirements

Regulatory compliance for slabs and ingots is a multi-layered filter that affects the final procurement cost and market viability. Anti Dumping Duties (ADD): The buyer must thoroughly verify if the slab/ingot’s country of origin is subject to any existing ADD or countervailing duties (CVD) imposed by the importing government. This due diligence is non-negotiable for a compliant steel slab purchase.

These duties can add 10%-50% to the cost, rendering the source unviable. This check must be done before the purchase order is finalized. Certification Mandates: Buyers must stipulate specific certifications. For slab used in pressure vessels or pipelines, API (American Petroleum Institute) certification is mandatory. For ingots used in aerospace or highly demanding tooling, AS9100 or specialized national defense standards may be required.

The MTC is useless without the accompanying regulatory compliance stamp. Certificate of Origin (COO): The COO must be obtained for every shipment to claim preferential duty rates under any existing Free Trade Agreements (FTAs). The buyer must verify its authenticity, as misrepresentation can lead to customs seizures and fines. Compliance verification ensures seamless customs clearance.

Macroeconomic and Geopolitical Risk Management

Slab and ingot purchasing exposes the buyer to systemic risks that can derail entire manufacturing schedules. Geopolitical Risk: Given the concentration of major slab suppliers in politically volatile or sanction prone regions, the buyer must implement a stringent Supply Diversification Plan. They should have pre-qualified suppliers in multiple, stable regions (e.g., Western Europe, North America, non-CIS Asia) to activate immediately if a primary source faces a sudden export ban or conflict-related port closure. Click here to view steel bloom

Currency Hedging: The buyer must hedge their local currency exposure against the USD-denominated purchase price. Utilizing Currency Forward Contracts locks in the exchange rate for the payment date, stabilizing the final local currency cost and guaranteeing the anticipated manufacturing margin. Failing to hedge turns the finance department into a price speculator. Force Majeure Auditing: The buyer must audit the supplier’s Force Majeure clause in the contract.

It should be fair, preventing the supplier from using minor market shifts (e.g., a small increase in energy costs) as an excuse to cancel the contract when global slab prices spike. Risk diversification ensures supply chain continuity reliably.

Sustainability, Innovation, and Future-Proof Sourcing

Environmental regulations are now a commercial reality that buyers must integrate into their sourcing strategy to ensure future market viability. CBAM Sourcing Strategy: For buyers in or selling to the EU, Carbon Border Adjustment Mechanism (CBAM) compliance is critical. The buyer must begin prioritizing slab suppliers who use Direct Reduced Iron (DRI) or high-quality scrap (EAF route) over traditional Blast Furnace (BF) suppliers. Sustainability is reshaping the steel slab purchase decision matrix.

Sourcing high-emission slabs creates a long-term carbon tax liability. PCF Data Demand: The contract must demand verifiable Product Carbon Footprint (PCF) data from the supplier. This data is the foundation of the buyer’s own compliance and green claims. Buyers should be prepared to pay a “Green Premium” for certified low carbon slabs to secure future market access and meet downstream customer demand (e.g., from automotive OEMs).

Sustainability Audits: Buyers are increasingly adding ESG (Environmental, Social, and Governance) requirements to their supplier audits, ensuring that the slab/ingot supplier maintains ethical labor practices and adheres to environmental standards, mitigating the buyer’s reputational risk. Innovation and Future Sourcing: The future of slab and ingot purchasing lies in embracing metallurgical innovation and digital supply chain management. Click here to view steel bloom

Advanced Slab Casting: Buyers should actively seek out suppliers using Thin Slab Casting (TSC) technology. TSC produces slabs closer to the final sheet thickness, offering energy savings and improved structure. Similarly, Electromagnetic Stirring (EMS) during casting improves internal homogeneity. Large Forging Ingot Innovations: For specialized ingots, suppliers using VIM/VAR processes achieve extreme cleanliness required for zero-defect components.

Digital Traceability and Blockchain: The purchasing department must prepare for Blockchain integration. This allows tracking every slab using a non mutable digital ledger, verifying mine source, energy used, and quality tests in real time. This transparency defends against fraud and greenwashing claims. Buyers should encourage key suppliers to adopt these digital platforms.

Inventory Management and Yard Operations

Once the procurement contract is signed and the vessel discharged, the strategic focus shifts immediately to Inventory Management. Storing steel slabs and ingots is not merely about finding space; it is a complex logistical operation involving massive weights, safety hazards, and the critical need to maintain absolute traceability. The final cost of a steel slab purchase includes these storage and handling complexities. A slab yard or ingot storage facility is the operational heart of the rolling or forging mill. Click here to view steel bloom

Poor management leads to “lost” heats, surface degradation, or catastrophic safety incidents. For the procurement manager, understanding the cost and complexity of this stage is vital for calculating the true Total Cost of Ownership (TCO). The strategy must balance the financial burden of holding capital-intensive stock against the operational risk of a stock-out that halts production. Efficient inventory minimizes working capital requirements significantly.

Yard Infrastructure and Handling Equipment: The physical infrastructure required to store slabs and ingots is immense. Ground Loading: The ground bearing capacity must be exceptionally high. Slabs are dense; stacking them four or five high can exert pressures exceeding 50 tons per square meter. A sinking foundation can topple a stack, causing fatal accidents.

Crane Systems: The yard must be equipped with heavy-duty overhead gantry cranes (EOT). For slabs, magnetic lifters are preferred for speed and maximizing stack density. However, for non-magnetic ingots, mechanical tongs must be available. The procurement team needs to ensure the arrival rate does not overwhelm the yard’s crane cycle time. Digital Locations: Every square meter must be mapped in the Warehouse Management System (WMS). Click here to view steel bloom

When a slab arrives, its Heat Number and physical location must be digitally logged. Preservation and Surface Integrity: While steel slabs appear indestructible, they are vulnerable to environmental degradation. Slab Oxidation: Standard carbon steel slabs can withstand outdoor storage. A thin layer of rust is expected, but deep pitting from standing water is unacceptable. Slabs should be stacked on dunnage to prevent ground contact. Proper storage protects the value of your steel slab purchase.

Ingot Sensitivity: High alloy ingots are far more sensitive. Some grades are susceptible to Thermal Shock or hydrogen cracking if exposed to moisture. These expensive ingots often require covered storage or climate controlled environments. Purchasing managers must factor premium warehousing costs into the procurement budget for specialty alloys. Proper storage preserves material value and processing yield.

Conclusion

A comprehensive and strategic steel slab purchase is the definitive cornerstone of profitable and resilient flat-rolled steel manufacturing. Mastery of this complex process, from the initial technical needs assessment through to final yard logistics, directly translates to superior mill yield, predictable production costs, and robust supply chain security.

By rigorously implementing the protocols for supplier vetting, enforcing stringent quality gates linked to financial terms, and proactively managing market, financial, and sustainability risks, buyers transform a routine steel slab purchase from a simple commodity transaction into a powerful competitive lever. Ultimately, the most successful steel slab purchase strategies are those that are fully integrated, viewing each procurement decision through the dual lenses of immediate operational efficiency and long-term strategic viability, ensuring the seamless flow of high-quality material that is the lifeblood of the rolling mill.

No Comment